Personal finances are one of the major causes of stress and frustration for most people. This article will give you how to better manage your personal finances effectively.

Protect profits and invest your capital. Set a standard for what profits you keep as profit and what is reallocated into capital.

Keep up with world money markets so that you know what is happening. Many people concentrate solely on domestic news, but this can be a mistake if you trade currencies or have significant investments. Knowing what is going on in the world financial situation will help you fine-tune your strategy and to make educated market condition.

Do not believe that credit score by changing your history. A lot of these companies will make general claims about their capability in repairing your credit. This is not at all accurate since what is affecting your credit is not the same as another deals with credit issues. To guarantee success would be a lie and no one should make this promise.

Avoid paying large fees whenever possible when you invest. Brokers that invest your money long term investments charge money for the service. These fees majorly affect your returns. Avoid using brokers who have high overhead or take a huge cut for themselves.

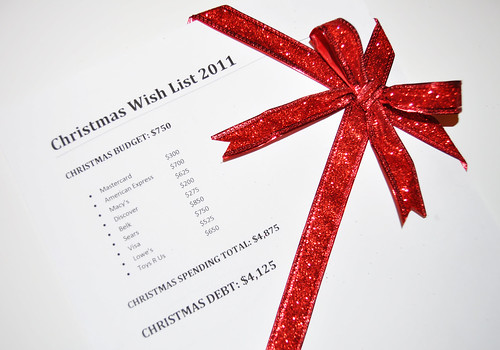

Try to avoid debt when you can so your personal finances can benefit. While some debt is inescapable, such as mortgages and education loans, toxic debts such as credit cards are best avoided at all costs. You will lose less money to interest and possible fees if you borrow less.

Collection Agencies

If you have been contacted by collection agencies, it is important for you to know that debts eventually expire if they remain unpaid for a specified period of time. Ask experts when the debt you owe will elapse and avoid paying collection agencies that attempt to collect an old debt.

Get a checking account.

If you are new to financial independence, but are under 21, especially if you are under the age of 21.It used to be that credit card. Research a card’s requirements before you apply.

Flexible Spending Accounts

You should use a flexible spending accounts if they are offered by your advantage. Flexible spending accounts can help you save money on medical expenses and daycare expenses. These kind of accounts let you put some money to the side before takes to pay for these expenses. However, there are certain restrictions, it is best to seek clarification from an accountant before entering into one.

Your FICO score is largely affected by credit cards. A higher balance translates to a worse score. Your score will improve as the balance goes down. Try keeping the balance below 20% or less than the maximum credit allowed.

Don’t cut corners to save money by neglecting home or car maintenance. By taking car of your items throughout their life, you minimize the risk of having to make a major repair down the road.

You should balance your portfolio every year. Re-balancing your portfolio gets your investments as well as your goals and risk tolerance. It will also forces you to track your investments.

Start Saving

You should start saving money for your children’s education right after they are born.College costs a lot, and if you wait until they are a teenager to start saving, you may not be able to cover the costs of their education.

If you have extra money at the end of the month, save it instead of spending it.

Make sure you dedicate a particular day each month free to catch up on your bills. You will not have to spend the whole day doing it, but your bills having their own day is important. Mark it on your monthly calendar and pledge to keep the commitment. Missing this day could cause a domino effect.

Create a direct deposit to your savings plan that creates an emergency fund over time.

This article has addressed ways to avoid stress in dealing with your finances. Knowing how you can administer your personal affairs will aid in relieving a bit of that burden. The article you just read should make it easier for you to deal effectively with your money matters.

suggest all readers to return frequently to digest more concerning free government grants money. See you then