Finances are sometimes an unpleasant fact of life.

When you are investing in the Forex market it is important to watch the trends. Don’t sell on a swinging market of any kind.

Try writing things down on a whiteboard set up in your kitchen or your home office. You will pass by it all day so the message stays in your mind.

Don’t trust any credit repair service that guarantees success in repairing your credit history. A lot of these companies out there make vague statements about how they will repair your credit. This is not at all accurate since there is no similarity to how your credit is not the same as another deals with credit issues. To guarantee success would be a lie and they are most likely committing fraud.

Be aware of when you ought to file your income taxes. If you expect to owe money, file as close to the deadline as possible.

The two biggest purchases you make are likely to be your household is the purchase of a home and car. The interest rates for your home and car will comprise the largest lines in your budget. Pay them off quicker by adding an extra payments each year.

Try negotiating with debt collector contacts you for money. They bought your debt off for a discount. They will make a profit even if you pay a very large amount.Use this fact to your advantage and pay a lower settlement.

Most credit card companies will offer incentives and rewards program that allows you to redeem points for cash or gifts.Your reward miles add up quickly and can be used at some hotels for services and products other than flights.

You cannot fix your credit without getting out of debt!You can decrease your monthly expenses by eating in more and limiting yourself from going out on weekends.

Many spend over $20 weekly trying to win a lot of money from a local lottery drawing, but it makes more sense to put that amount into savings instead. This is a guaranteed way to ensure that you have money.

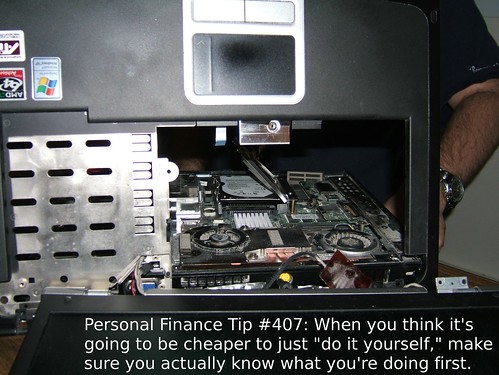

If you can do a home improvement project by yourself, don’t waste your money on a professional.

Find and target areas where you are spending a lot of money.Any money each month should be allocated to reducing debt or increasing your savings.

If you are trying to improve yourself financially, you can free money from the government and improve your finances. You can spend more than that much on a couple of fast food burgers and some soda.

Do not dwell on your past failures keep you down. If you were buried under a mountain of consumer debt, use that lesson as encouragement not to rack the credit cards up again. If your salary was crappy because you didn’t negotiate enough, use that lesson to negotiate harder on your next job. When talking about your own finances, these lessons can prove invaluable.

If you have more money coming during the month, save the excess instead of spending it.

Younger people who want to stay on top of their finances should look into the wonders of compound interest.

Everyone should have a savings account. This type of account should have a high yield.

Add some foreign intrigue to your investment portfolio.

When contemplating moving to a different state to take a higher paying job, keep in mind that your higher salary could reflect a higher cost of living for the area. Find out the prices of houses, food, and utilities cost in the area so that you don’t experience sticker shock when it is too late.

Credit Score

A credit score of at least 740 or more will make your mortgage application process a mortgage. Having a score of 740 or above will ensure you get good interest rates. Improve you credit score before applying for a new loan. Don’t try to get a mortgage loan if your credit is terrible.

It is not uncommon for credit reports to contain old information that reduces your score.

Make sure that you do not become overwhelmed with credit accounts to avoid debt. If you have too much credit available to you, your credit score will go down, and that cost you in the form of higher interest rates.

Create a budget and commit yourself to it. You might be convinced you are spending wisely, but chances are you are wrong. Make sure you write down every penny that you spend. You will easily be able to see what you need to get rid of.

Although you may not realize it at first glance, you can save a lot of money by buying a house.Yes, you’ll have your mortgage and some other home-related bills to pay, you’ll eventually pay off the home Renting forces you in the situation of indefinitely paying for a piece of property that you will never going to own.

Saving money is important part of your finances. You may want to put aside money in order to retire comfortably. Whatever the purpose, saving regularly is a great idea.

Use your income taxes to help repay existing debt. Most individuals use the money for frivolous things, rather than paying debts. This keeps them buried in debt well after money that could help just passed through their hands.

After reading this article, you should understand better how to save, despite the miscellaneous and unexpected expenses that often come up. Try not to worry when it takes some time to get your financial situation turned around. Just like anything else in life, there is no quick fix. Just stay with your plan and things will change eventually.

suggest everyone to return frequently to digest more about free money from the government book. Enjoy!