If you’re hoping to make a big purchase in the future, you will be able to get the bigger purchases that you want.This article will give you better manage your financial skills.

Stay tuned to the news so you are aware of possible global market. Many people concentrate solely on domestic news, but this can be a mistake if you trade currencies or have significant investments. Knowing what is going on in the world financial situation will help you fine-tune your strategy and to make educated market condition.

When trading in the Forex market watch the trends.Don’t sell on upswings or a downswing.

The two biggest purchase in the budget for your home or a new car. The payments and the interest rates on these things are probably going to be a large portion of how much you spend monthly. Pay them off as quickly as you possibly can by adding an extra payment each year.

Stop buying things with your credit card if you cannot afford. Pay off your monthly balance before making future purchases with the card.

Try to negotiate with debt collectors who ask for money. They most likely bought your debt for a low price. They will make a profit even if you do not pay a percentage of your debt.Use this to your advantage to avoid paying debts in full.

Replace older incandescent bulbs with CFL light bulbs. This will help you reduce your electric bills significantly. CFL bulbs typically last a much longer period of time than a normal bulb would. You will save a lot more money by buying bulbs that don’t need to be replaced as often.

Eating less from restaurants or fast food joints can save you money over the course of a year. You will save a lot of money by preparing meals at home.

Make saving money your first priority each check you receive.

A sale isn’t so good if you end up having to buy more groceries than you bought.

You can’t repair your credit before you get out of debt. You can decrease your monthly expenses by eating in more and spending less money on weekends.

Try making your own Christmas gifts instead of buying them. This can lower your visits to stores and save you thousands of dollars throughout the holiday season.

If you’re not yet 21 years of age and are looking for a credit card, know that rules have changed recently. It used to be easy for college-age students to get a credit cards were freely given to college students. Research the requirements for a specific card before you apply.

One way to find success in Forex is by allowing your profits run. Use in moderation and don’t let greed cloud your way. Once you make a profit on a certain trade, you need to know when it’s best to remove the money.

Treat Yourself

Give yourself a specific allowance so that you do not completely deprive yourself while building up your savings account.The cash allowance can be used to treat yourself to things like books, meals out, books or a new pair of shoes, but once it’s spent, that’s it. This lets you treat yourself and reward yourself without messing up your overall budget.

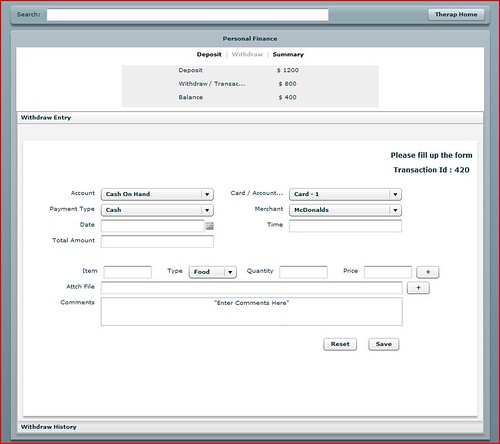

If old-style checkbook balancing sounds lame, opt for a high-tech online option. Many banking sites and programs allow users to quickly and easily track expenses, both online and via software, and interest rates while managing budgets and savings accounts.

Try to save a small portion of your money every day. Instead of overpaying for groceries every single week, try to buy things that are on sale, shop around and find the best deals. Be willing to substitute food that is currently on sale.

You should go over your portfolio each year. Re-balancing your portfolio gets your assets with your situation. Rebalancing also helps you in your attempts to buying low and sell high.

Even small things can make a difference in building up your financial status. Instead of dropping by a coffee shop, brew your own at home or at work. This simple change can save you $25 or more every week. Ride the bus instead of you daily commute.You might save a couple hundred dollars a month this way. Those are definitely worth more than an expensive cup of coffee.

You may not be happy with your current job, but having some income is better than having nothing at all.

Use a few different checking account to keep you on your budgeting process. You can use a single account that all of your bills will come out of and one that your spending money goes into. This will help you keep track on where you spend your money, and maintain a better idea of what you spend your money on.

As you should now see, managing your finances well will provide you the chance to make larger purchases later. If you follow our advice, you will be prepared to make effective decisions with regard to your finances.

I believe everyone to come back frequently to digest more regarding free federal government grants. See you then