Money may not buy happiness, but having it can give you a sense of security. Having a lot of money can reduce stress and anxiety. A major cause of stress and unhappy because their personal finances aren’t in order. Money can buy happiness, keep reading to enhance your finances.

Do not invest any money on something that promises to make money easily. This is something that many Internet marketers fall victim to. Learn as much as you can, earning it through hard work and patience.

Profits should be protected and reinvested as capital invested. Set a standard for what you keep as profit and what is reallocated into investments.

Restaurants in busy tourist areas tend to be the highest priced, so look into where the locals go out to eat. You can find quaint restaurants with lower prices and tastes better.

Stop loyal purchasing of certain brands unless there are coupons for them. As an example, if Tide has normally been your detergent of choice, but Gain has a $3 off coupon available, purchase the Gain and save some money.

Keep an envelope in your wallet or purse. Use this to store all of your receipts or business cards. You may need these receipts later to compare to your credit card statements in the small chance that you are double charge or other error shows up.

The interest from multiple credit cards is typically lower than trying to pay off a card that is maxed out.

If you want financial stability, open a high-yield savings account and keep putting money into it. Having enough savings on hand means you won’t have to use your credit cards or take out a loan in an emergency. Even if it’s impossible to make a significant contribution each time, you should still save up what you can.

Your car is one of the most important purchases that you will make in your life. You can also look for a vehicle online on dealership websites.

You can sell an old items for a little extra money this month.

Try to set up an arrangement in which you use your debit card automatically pays off your credit card at the end of the month. This will make sure that you forget.

Give yourself a “pocket cash” allowance so that you don’t overspend. The cash can be used for treats like coffee with friends, new music, books or a new pair of shoes, but when it’s gone, you’re done until the next allowance. This lets you can reward and not blow your overall budget.

If old-style checkbook balancing sounds lame, then you can do it online. Many banking sites and programs allow users to quickly and easily track expenses, both online and via software, and interest rates while managing budgets and savings accounts.

Do not think you are actually saving money by not doing maintenance on your vehicle or car. By taking car of your items throughout their life, you are preventing future problems.

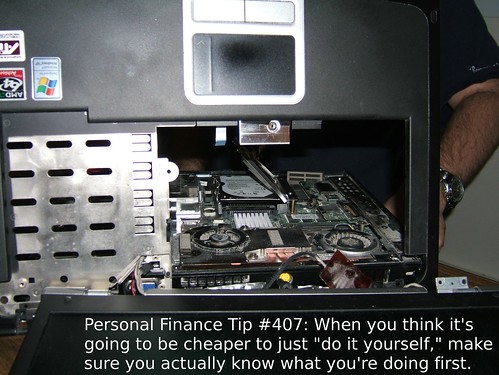

If you have the ability to improve your home on your own, you should not pay someone else.

Try to pay off debt and do not build up any deeper. It’s quite simple actually, even though we have become trained to think it is impossible.

New laws have been enacted recently to allow merchants to determine a minimum transaction amount on credit card usage.

Credit Cards

Do not let your financial mistakes; learn from them instead.If you have spent a while fixing debt with credit cards, use that as an incentive to avoid opening up additional credit cards. If you have been making less that what you deserve, make that a lesson to you to remember to negotiate more with your next opportunity. When managing your money, learn as much as you can.

This article will have hopefully helped you understand more about finances and how to manage them. Though the contribution in terms of energy and effort may seem daunting, the changes necessary for financial content will make for a happier and healthier lifestyle in future years. A peaceful, unstressed person is a happy person. Never forget that your ultimate financial goal, beyond any amount of money you wish you had, is your personal happiness.

We believe all readers to return often to digest even more regarding free money from the government to pay bills. Enjoy!